Can You Keep Your Rental Properties During a Bankruptcy?

During a bankruptcy, your assets are often liquidated to pay off your creditors. But rental properties can make this a little more complicated. You won't necessarily need to get rid of your rental properties during bankruptcy, but it depends on the profitability and equity you hold in the property itself.

There Are Property and Asset Exemptions to Bankruptcy

Don’t assume that you will need to liquidate all of your assets during a bankruptcy. In fact, exemptions include your home, your car, your retirement accounts, and some amount of your personal property. Many people are surprised to find out how much they are allowed to keep during the course of their bankruptcy. And this can even include a rental property.

Rental Properties May Not Have Any Equity

Consider a property that is valued at $200,000 but presently has a $200,000 mortgage. A bankruptcy isn't going to be concerned with this property, because it isn't technically an asset; you owe as much on it as it's worth. Selling it will only pay off the mortgage, it won't pay off any of your additional debts.

So, your rental properties aren't likely to call attention to themselves if you have no equity in them. If you have low equity, they may fall under the asset exemptions: you can keep a certain value of property, depending on the state that you're in.

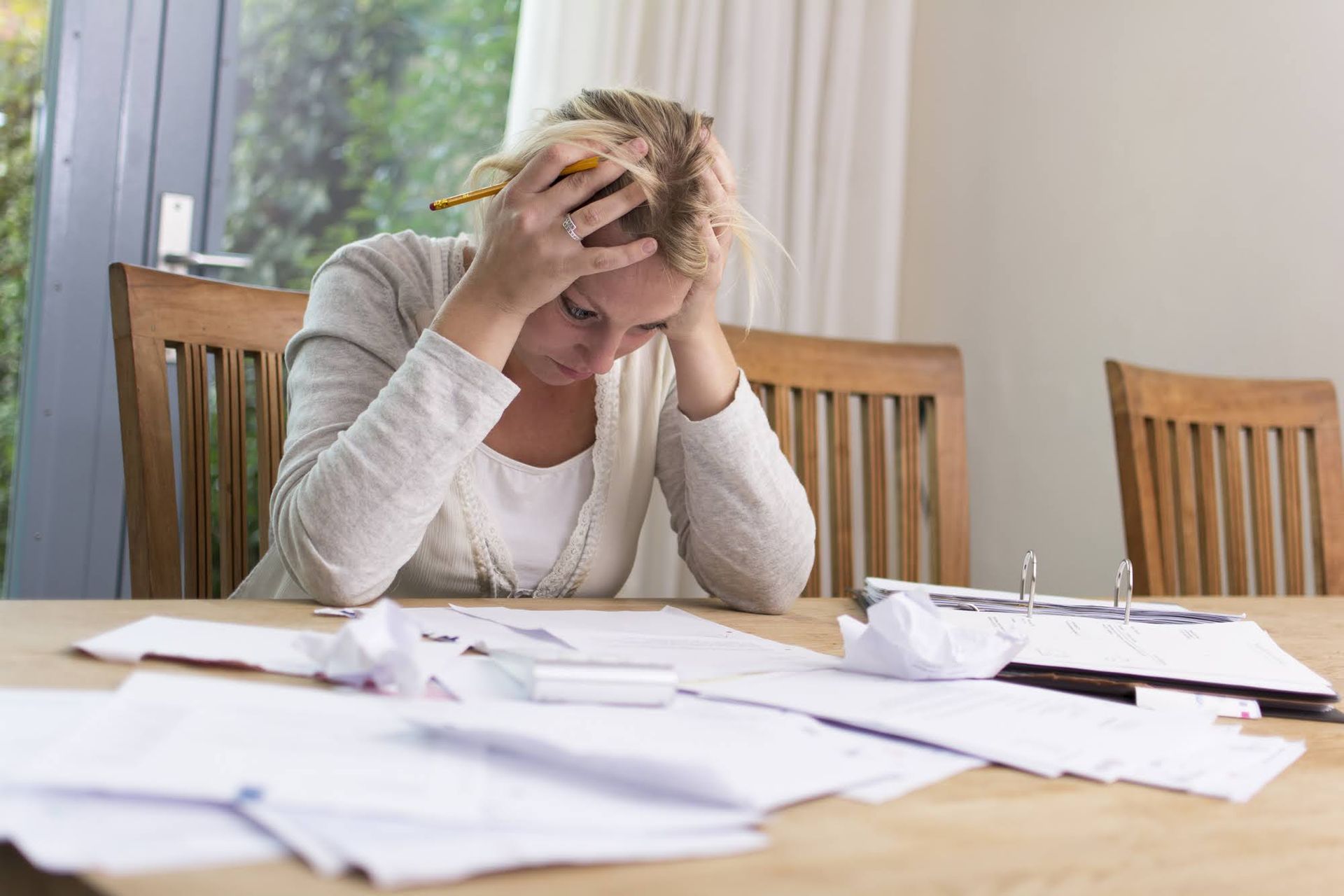

Rental Properties May Not Be Profitable

Profitability does matter in regard to rental properties. If you're losing a significant amount on your rental properties, they're going to be considered a liability. Since they're considered a liability, your bankruptcy trustee will likely tell you to liquidate these properties before you move forward. This is independent of the property's value: the trustee's goal is to ensure that you can pay off your debts.

Thus, if your rental property currently costs more to maintain than it brings in, you may need to consider selling the property. However, if your rental property is breaking even, and you don't hold much equity in it, you may be able to keep it.

Chapter 13 Bankruptcy Doesn't Liquidate Your Assets

Consider also that only Chapter 7 bankruptcy liquidates your assets. Chapter 13 bankruptcy instead negotiates a payment plan for you, so you can pay off your debts over time. If you are able to pay off your debts in this way, it may be the best solution.

Chapter 13 bankruptcy is unlikely to impact your rental properties, unless you cannot pay for those properties. If you can't pay for those properties, you may be better off doing a Chapter 7 bankruptcy.

You May Be Asked to Re-Affirm Your Debt

When you keep a home, car, or other type of property during a bankruptcy, you are often asked to reaffirm that debt. Reaffirming the debt means that you sign the paperwork again following the bankruptcy, and the lender isn't required or guaranteed to allow this.

That means that even if you are allowed to keep a rental property, the mortgage may not be reaffirmed. Creditors may not want to maintain the mortgage if they feel that you may be in dire financial trouble, and your credit score is likely to have gone down.

However, you can sidestep issues caused by this by working with your lender in advance. Your lender will be able to tell you whether they're willing to continue working with you, or even whether they may be able to restructure your debt to be cheaper.

Bankruptcy is complicated. There are a lot of factors to consider, and everyone's financial situation is unique. To find out more, contact Charles J. Schneider, PC, today.