Borrowers, Co-Signers, and Bankruptcy — What Can You Both Expect?

Many bankruptcy cases involve only one individual — the filer, or claimant — and their own personal debts. However, some claimants share debt with other individuals through the process of co-signing, or legally agreeing to pay a person's debt if they do not. Whether you're a co-signer or the person who has a co-signer, protecting both of you starts with understanding how bankruptcy affects everyone. Use this short guide.

How Bankruptcy Affects Co-Signers

Technically, a borrower's bankruptcy doesn't directly involve any co-signers. This is good because the bankruptcy won't damage their own credit. However, it's also tricky because they do not receive any discharge of their responsibility for the debt. In effect, when you receive a debt discharge, this is only a discharge of your legal responsibility to pay it — not the removal of the debt entirely.

The effects of such a discharge on the co-signer depend on many factors, including which Chapter of bankruptcy the main debtor chooses. Chapter 13 cases may receive a co-signer stay, which prevents the creditor from pursuing repayment from the co-signer if the loan is reaffirmed and paid in full. However, Chapter 7 bankruptcy may offer no co-signer protections.

What Actions Co-Signers May Take

Anyone considering bankruptcy should notify their co-signers before filing. Before filing, the borrower may request that a creditor remove a co-signer from the loan to avoid bankruptcy entanglements. This is difficult but may be possible if the borrower is in good standing.

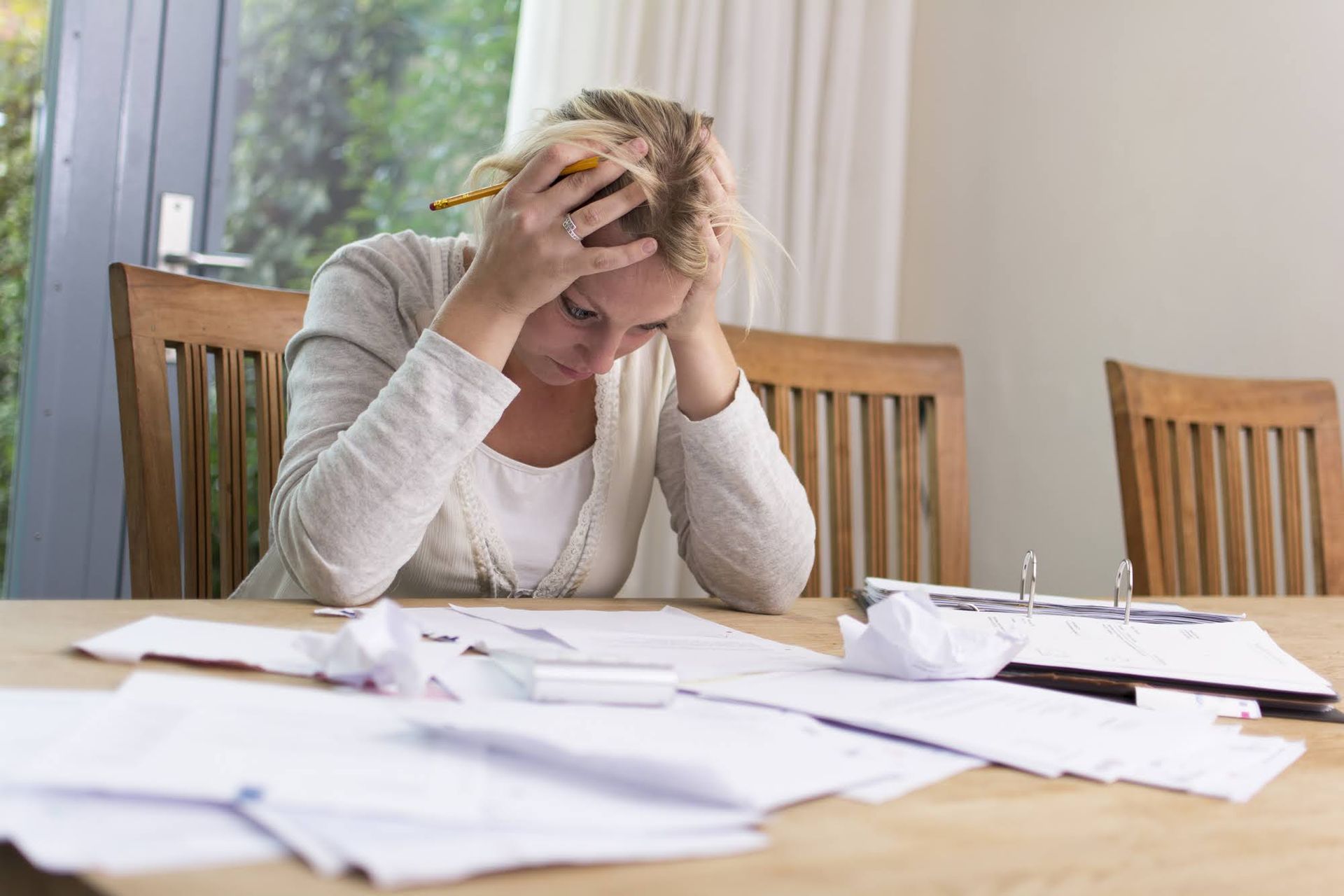

Unfortunately, a co-signer may need to file for their own bankruptcy protection if they can't comfortably pay the debt. The situation may be exacerbated if the lender immediately puts the debt in default and demands payment from the co-signer. If this happens on a large debt, the co-signer's only choice may be to relieve their own financial burden through personal bankruptcy.

How a Co-Signer's Bankruptcy Affects Debtors

What if the co-signer is the one who files for bankruptcy? Again, this doesn't directly affect the borrower's own assets or debt due. And in some cases, this may not even be noticeable to the main borrower. However, the way that a lender responds to the bankruptcy can cause unwelcome problems anyway.

The most common effect is that the borrower's account may go into default or they might be barred from making payments. This can happen due to the automatic stay put on debts or even through the lender being overly cautious about making missteps during a bankruptcy case. Not only can this cause an actual default but will likely damage the borrower's credit score.

What Actions Debtors May Take

The best starting place for a debtor whose co-signer files bankruptcy is to talk with lenders directly. Explain what's happened (or going to happen) with the co-signer and reaffirm the intent to continue paying the debt in full. Advance warning can forestall automatic responses to the bankruptcy notice. If the creditor won't work with the borrower, an attorney may convince them to restore the borrower's good standing.

If the borrower has the means, now may also be a good time to work to remove the co-signer from the loan. The borrower can request this move on an existing loan, but they may need to refinance the loan to separate themselves from the co-signer.

Whether you're a borrower or a co-signer, the best place to begin is by learning more about the possible effects of bankruptcy on your personal situation. Charles J Schneider PC has assisted Michigan debtors with all their debt relief needs for more than 45 years. Call today to get answers to your questions and learn the best first steps to take to protect yourself.